Up To $1 Million in Collections For $400/Month

Bookkeeping Service for Dentists

With Benchmarking Analysis Report

No QuickBooks Online Subscription Needed. Saves you $60/month.

You can't fix what you don't KNOW is broken.

If you don’t know your overhead costs, you can’t fix them.

- You don’t know how you compare to your peers.

- You don’t know where your money is spent.

- Your bookkeeping is behind.

- Transaction are categorized incorrectly or are in “Ask My Accountant”

Control your expenses and be more profitable with bookkeeping consistently completed each month.

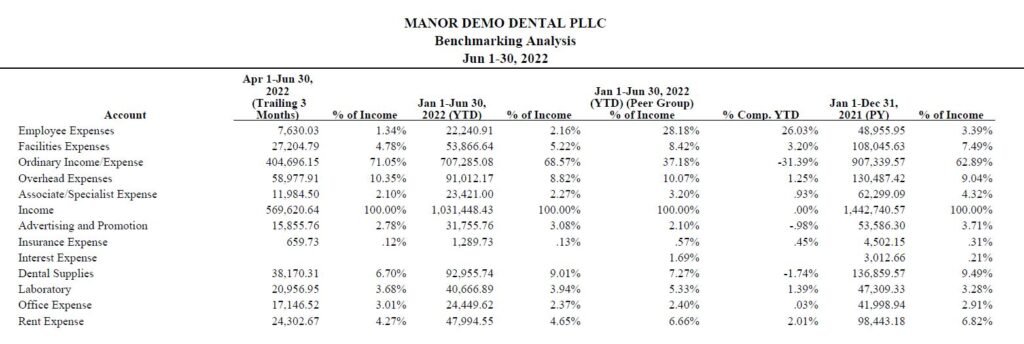

Benchmarking Analysis Report

We provide bookkeeping services for dentists in a manner that is consistent for all our clients. This enables us to confidently do peer to peer comparison. You receive this report showing how you compare to your peers. This report shows the expense groups or accounts of your choosing. It includes trailing 3 months, year to date and prior year expenses and percentage to your collections. Plus it has the average percentage of collections spent by other dental practices for the same groups/accounts for the same period. This clearly highlights where you are spending your money and how it compare to your peers. This allows you to identify areas of improvement for your dental practice to be more profitable.

This report is not available in QuickBooks.

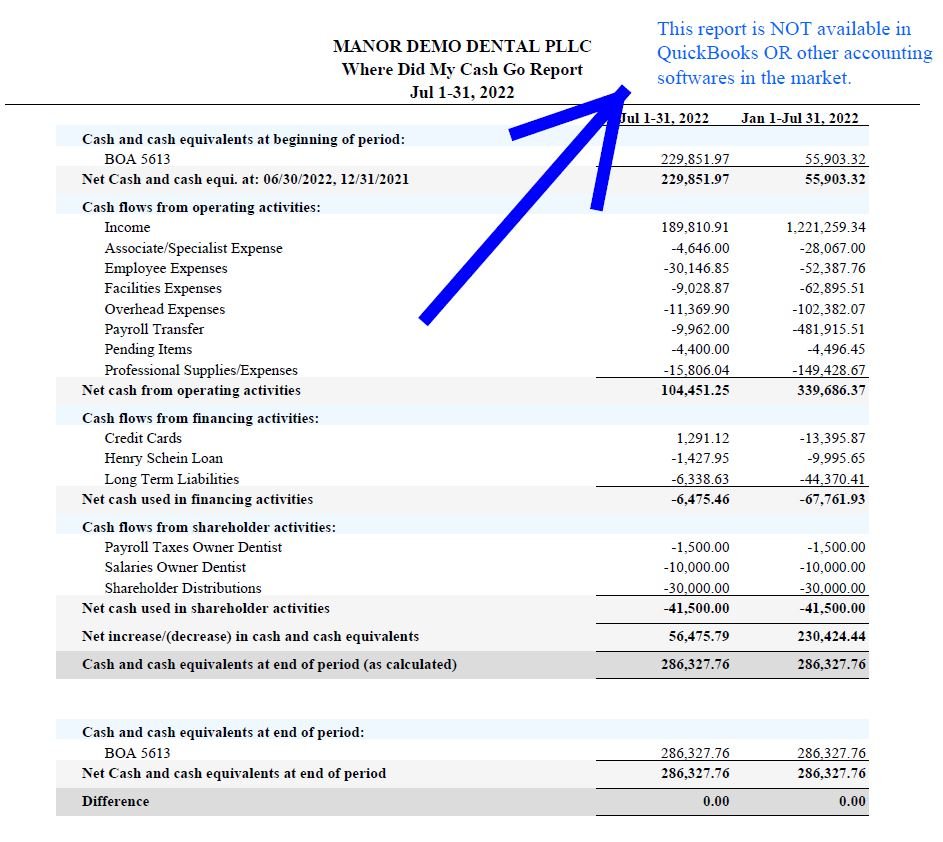

Where Did My Cash Go Report

We often get phone calls from dentists confused about where their cash went. Therefore, we built a report that removes this confusion.

We provide a Cashflow report that is easy to understand. It starts with the cash you started with for the month and year to date. It then shows where your dental practice spent the money for operation, financing or investing activities. It then shows the money that was spent for the owners of the dental practice.

This report is not available from QuickBooks.

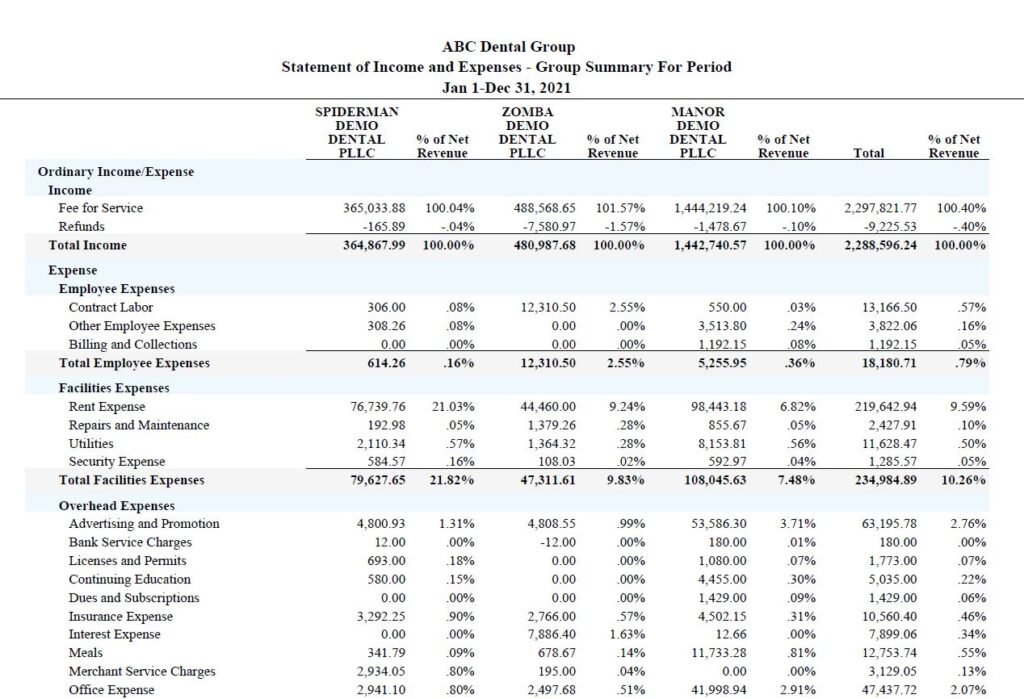

Combined Profit and Loss Statements

We provide combined profit and loss statements for multiple practice owners. This allows them to review multiple practices at the same time and the total income/expenses of all practices in one report. This may also be helpful from a tax standpoint since it summarizes the income for your tax accountant.

This report is not available in QuickBooks.

Bookkeeping For Dentists

We provide bookkeeping services for dentists only. We provide bookkeeping for over 70 dental practices each month. Therefore, we know how to categorize transactions correctly, which leads to accurate financial statements and less questions for you.

Testimonial

See what our customers are saying

EXCELLENTBased on 13 reviews Trustindex verifies that the original source of the review is Google.

Trustindex verifies that the original source of the review is Google. Colin Boswell2023-08-13DJ does a fantastic job - we are lucky to have him on our team. He is very thorough - and always very responsive and helpful in answering questions.Trustindex verifies that the original source of the review is Google.

Colin Boswell2023-08-13DJ does a fantastic job - we are lucky to have him on our team. He is very thorough - and always very responsive and helpful in answering questions.Trustindex verifies that the original source of the review is Google. Ankit Shah2023-02-10Honest and trustworthy CPA for dentists!Trustindex verifies that the original source of the review is Google.

Ankit Shah2023-02-10Honest and trustworthy CPA for dentists!Trustindex verifies that the original source of the review is Google. Alessandro Milani2020-08-17DJ is always willing to answer our questions and concerns throughout the year. He provide great customer service, very professional, and an expert for the dental field. We feel that our CPA care about his clients and want to assist anyway. Dr. Lee and myself would highly recommend DJ Bhola CPA CP for any service that he offer. Thank you DJ! Alessandro Milani, DMD Namhee Lee, DDS Lee & Milani Family Dentistry Milani DentalTrustindex verifies that the original source of the review is Google.

Alessandro Milani2020-08-17DJ is always willing to answer our questions and concerns throughout the year. He provide great customer service, very professional, and an expert for the dental field. We feel that our CPA care about his clients and want to assist anyway. Dr. Lee and myself would highly recommend DJ Bhola CPA CP for any service that he offer. Thank you DJ! Alessandro Milani, DMD Namhee Lee, DDS Lee & Milani Family Dentistry Milani DentalTrustindex verifies that the original source of the review is Google. Alan Katende2020-07-24I started a practice two and a half years ago. DJ has been my CPA since the beginning. He is the best. He goes above and beyond for his clients.Trustindex verifies that the original source of the review is Google.

Alan Katende2020-07-24I started a practice two and a half years ago. DJ has been my CPA since the beginning. He is the best. He goes above and beyond for his clients.Trustindex verifies that the original source of the review is Google. Martin Pak2019-02-14DJ is the Best! Been working with him since opening my new practice. Highly recommended.Trustindex verifies that the original source of the review is Google.

Martin Pak2019-02-14DJ is the Best! Been working with him since opening my new practice. Highly recommended.Trustindex verifies that the original source of the review is Google. Kyle Boenitz2019-02-14DJ is great. He has been a great asset to our dental practice. He's always responsive to needs and quick to answer any questions that we have. He's very knowledgeable and has done a great job. We would definitely recommend him.Trustindex verifies that the original source of the review is Google.

Kyle Boenitz2019-02-14DJ is great. He has been a great asset to our dental practice. He's always responsive to needs and quick to answer any questions that we have. He's very knowledgeable and has done a great job. We would definitely recommend him.Trustindex verifies that the original source of the review is Google. Regina Shvets2018-09-06I had called DJ Bhola related to my husband's recent employment change to an independent contractor. DJ went out of his way to provide pertinent advice about our situation despite the fact that we were not the client population his firm works with and knowing full-well he would not be benefiting from obtaining our business. He took time out of his schedule to speak to me when he could have just punted me off and provided what information he could. So while I can't speak to his accounting/consulting services, I was very impressed with the professional information and tips he did provide to me on our call, as well as his desire to help.Trustindex verifies that the original source of the review is Google.

Regina Shvets2018-09-06I had called DJ Bhola related to my husband's recent employment change to an independent contractor. DJ went out of his way to provide pertinent advice about our situation despite the fact that we were not the client population his firm works with and knowing full-well he would not be benefiting from obtaining our business. He took time out of his schedule to speak to me when he could have just punted me off and provided what information he could. So while I can't speak to his accounting/consulting services, I was very impressed with the professional information and tips he did provide to me on our call, as well as his desire to help.Trustindex verifies that the original source of the review is Google. Namhee Lee2017-09-25DJ is sincerely honest, trustworthy professional accountant for dentistry. He is truly responsible, informative and considerate to our matters and needs. Thanks to DJ, without his guidance and advice, I could not think where to start for my dental practice . I highly recommended DJ to my colleagues and friends!Trustindex verifies that the original source of the review is Google.

Namhee Lee2017-09-25DJ is sincerely honest, trustworthy professional accountant for dentistry. He is truly responsible, informative and considerate to our matters and needs. Thanks to DJ, without his guidance and advice, I could not think where to start for my dental practice . I highly recommended DJ to my colleagues and friends!Trustindex verifies that the original source of the review is Google. Krutarth Parikh2016-06-28DJ is very honest and knowledgeable. Extremely responsive and very attentive to our individual needs.Trustindex verifies that the original source of the review is Google.

Krutarth Parikh2016-06-28DJ is very honest and knowledgeable. Extremely responsive and very attentive to our individual needs.Trustindex verifies that the original source of the review is Google. Pamee Shah, DDS2016-06-15I met DJ after extensive search for accountants that were knowledgable of the dental industry and yet not limited to factoring in life's other finances and financial goals. DJ takes "into account" it all, and is clear, concise and informative. Through these first few months in a new start up dental practice, the importance of an available and knowledgable dental team is paramount, and I could not be happier with DJ's services!

Pamee Shah, DDS2016-06-15I met DJ after extensive search for accountants that were knowledgable of the dental industry and yet not limited to factoring in life's other finances and financial goals. DJ takes "into account" it all, and is clear, concise and informative. Through these first few months in a new start up dental practice, the importance of an available and knowledgable dental team is paramount, and I could not be happier with DJ's services!

Meet Our Bookkeepers

DJ Bhola, CPA

DJ has been providing bookkeeping services to dentists for over 12 years. He has a laser like focus on the business of dentistry and related taxes.

Megan Smith

Megan has been providing bookkeeping services for dental practices for 5 years.

Yan Xie

Yan has been providing bookkeeping services for dental practices for almost 2 years.

Pricing

Pricing packages designed for your success

You don’t need QuickBooks (Saves you $60/month for each entity)

We do bookkeeping for your dental practice so that you can make better/informed business decisions. Also, it helps your tax accountant do tax projections and make suggestions to reduce your tax burden.

What's included

Includes reports you need to make better business decisions and get ready for taxes.

- We enter all transaction (you don’t have to lift a finger)

- Reconcile bank/credit card accounts

- Updated Financial Statements Each Month

- Combined Profit and Loss for Multiple Practice Owners Each Month

- Complete Tax Package For Your Tax Accountant

- You don’t need QuickBooks (Saves you $60/month for each entity)

- Benchmarking Analysis Report

- Filing form 1099

- Phone calls/meetings/advisory services related to your dental practice

Services we don't offer:

Tax preparation outside Texas (See https://www.bholacpa.com/dental-cpa-fees/ if you need tax preparation and you are in Texas)

We don’t pay bills or write checks

We don’t reconcile day sheets/receivables

We don’t run payroll